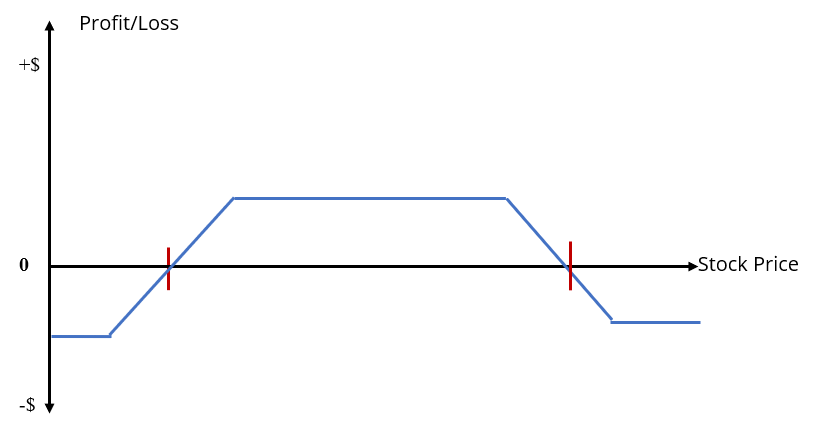

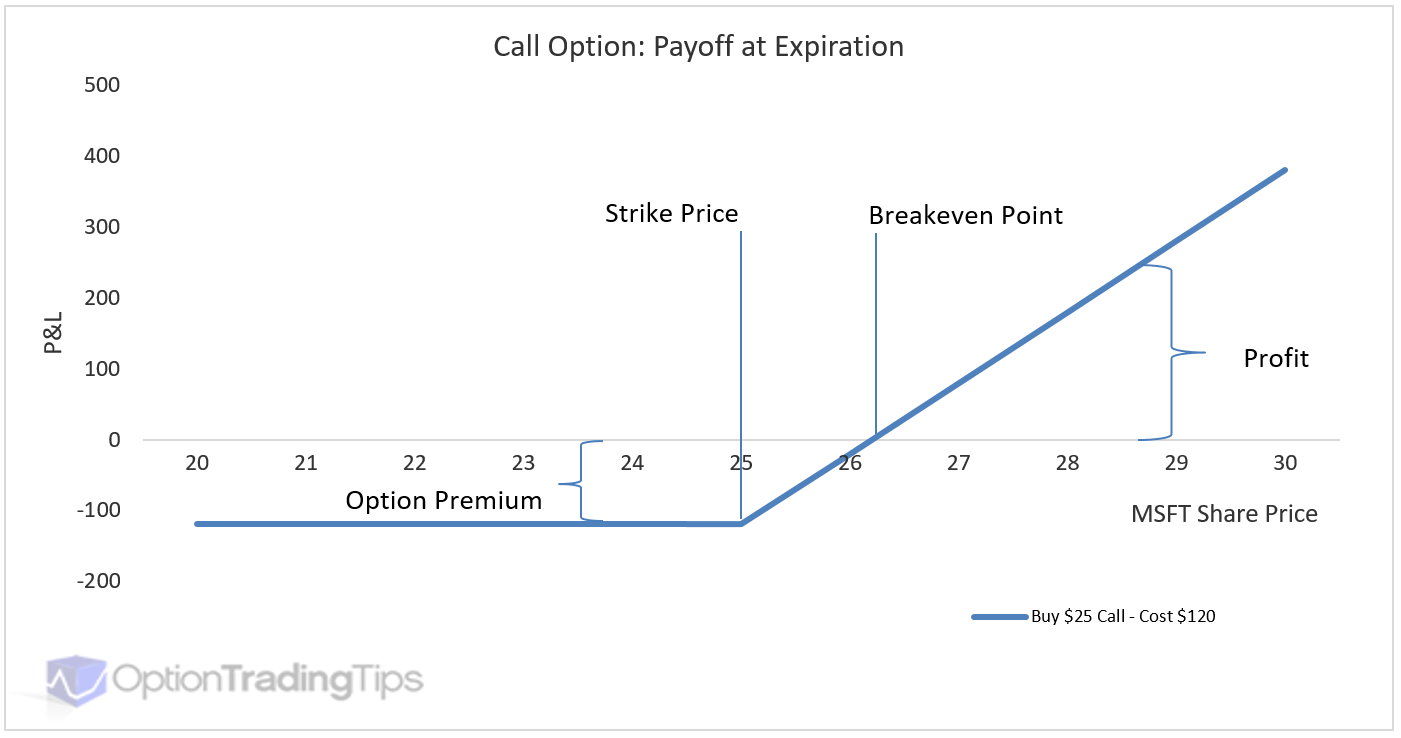

That way, you can then exercise your option, buy the stocks at a lower price and sell them to realize a profit. You ultimately want the underlying asset to increase above the strike price. When you purchase a call option from the option writer or seller, the two of you agree on the strike price, or what you’d pay to buy the underlying stock. Option premium: The price you pay to buy an option contract. Strike price: The set, agreed-upon price at which an option holder can buy or sell the security.Įxpiration date: The day an options contract expires, and you can no longer execute the contract. In other words, “putting” the stock away from you.īefore we further explain how trading these two types of options works, let’s cover a few important terms. Put options give you the right to sell shares of stock at a certain price on or before the option’s expiration date. Think of this as “calling” the stock to you. Call options give you the right to buy stock shares at a predetermined price (the strike price) on or before the option’s expiration date. You can invest in two basic types of options: calls and puts. But you do have the potential to reap capital gains from your investment. You also don’t have an opportunity to earn dividends with options trading. There’s no direct ownership of the company at all. When you invest in stock options, you essentially purchase the right to buy or sell shares of an underlying stock for a set price at a future date. Stock options, also commonly referred to as simply options, are different. When you invest in stocks through a self-directed account, like with Ally Invest, you decide which stocks you want to buy (or sell) and how many shares and can execute those trades on your own. A dividend is a payout the company makes to you typically on a monthly, quarterly or annually basis just for owning the stock. Some stocks have an added benefit: paying dividends. When you do so, you realize profits, a.k.a. When you invest in stocks, the goal is to buy shares at one price, then sell them at a higher price. When you buy one or more stock shares, you purchase part of the company that issued the stock. What are stocks and how do they work?Ī stock is an ownership share in a company. Stocks: What’s the difference?īefore you can make a confident decision about which types of investments best fit your style, you have to understand the fundamentals. Read on to learn more about the difference between stocks and options, and how trading options (or stocks) can be right for you.

Investment know-how also comes into play, and that’s where we can help.

stocks or leaning toward a combination of the two, you’ll want to look at several factors, including your goals, timeline and risk tolerance. Whether you’re deciding between options vs. Stocks may be your go-to pick, but options can also be a wise choice for your portfolio. You have lots of choices (chicken or beef? French fries or side salad?), but not all of them suit your appetite. Building a portfolio can be like dining out.

0 kommentar(er)

0 kommentar(er)